MANA Tech delivers a complete, vertically integrated, cloud-based solution for data, research, and rapid prototyping and deployment of tools

Cloud computing

Data resides and remains in the cloud to minimize storage and transport costs while maximizing robustness, security and access to on-demand compute power

Domain Specific Languages

MANA's proprietary domain-specific languages, m and SLOB were created explicitly for quantitative finance with an extremely terse syntax which is highly expressive for typical operations in statistical arbitrage

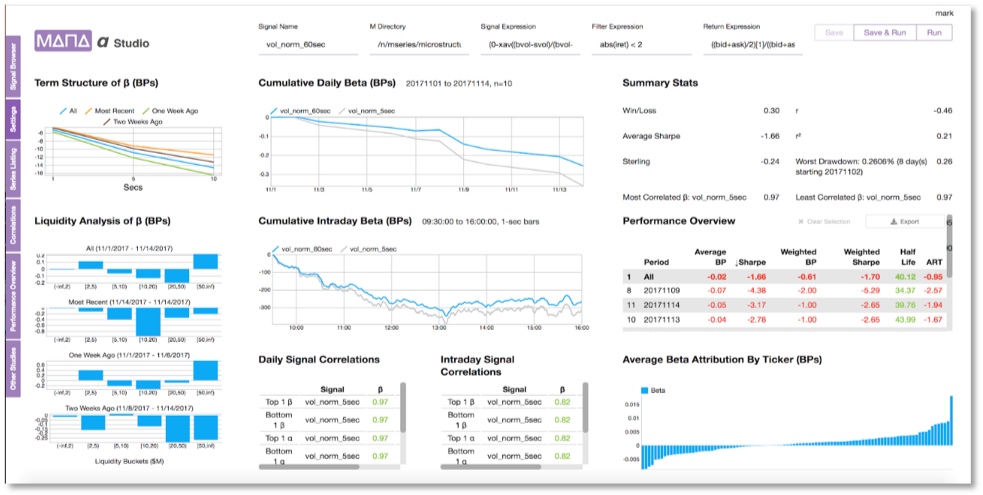

MANA App store

MANA Tech offers users pre-built tools such as a Portfolio Builder or a Market Simulator, while also allowing users to use our rapid prototyping language to create their own custom built research and trading applications